Go Beyond Identity. Understand Intent

Go Beyond Identity. Understand Intent

Darwinium is the AI Fraud Prevention company, built to protect and grow revenue at every touchpoint across the customer journey. Its edge-based risk decisioning platform distinguishes trusted from risky human and AI behavior, resulting in 50% less fraud and 40% greater operational efficiency. From first interaction through high-risk actions and payments, Darwinium protects the moments that matter most, so digital leaders can confidently grow and protect revenue.

Fight AI-Powered Fraud

Born in the era of AI to uniquely fight AI fraud. Authenticate every human and agent by intent, not just identity. Orchestrate remediation by risk, without frustrating good customers.

Protect and Grow Revenue

Complete protection from the moment a user or agent lands on a site, through every interaction they make: from account creations, to login, change of details, content listings, checkout & payments.

Edge-Native Security

Monitor, protect and remediate from the perimeter edge, via your content delivery network (CDN). New touchpoints, new threats, covered instantly, no code. Adapt at the speed of AI.

Just Launched: Agent Intent Detection to Secure the Agent Economy

Darwinium’s agent intent intelligence introduces a new model for digital trust. It goes beyond simply authenticating the agent; it evaluates behavioral intent, and dynamically applies the appropriate level of friction based on risk.

Deployed natively at the edge across major CDN providers including Cloudflare and AWS CloudFront, the solution determines whether a request originates from a verified AI agent, a human user, or malicious automation. It then analyzes real-time behavioral signals and journey context to decide whether to permit, verify, challenge, or prevent the interaction.

An Introduction to Darwinium

Understand true user intent, with full visibility of fraud and risk intelligence across security, fraud and customer experience teams.

Use Cases

Combine individual use cases across web, mobile and API endpoints, with full customer journey-level visibility

Account Security

Integrate one and protect every interaction. Analyze risks across pre-browsing behaviors, through to account creations, logins, details changes, checkout and payments.

Learn more

Fraud Prevention

Protect against account takeovers, payment fraud, shipping and returns fraud. Identify behavior indicative of scams and social engineering across payment journeys.

Learn more

Abuse Prevention

Prevent bonus abuse, business logic abuse and API abuse. Detect fraudulent or abusive content before it is uploaded. Protect end user trust and safety.

Learn more

Onboarding

Identify malicious automated bots and human click farms developing fake accounts. Streamline integration of third-party authentication / KYC checks for a slick onboarding experience.

Learn more

Account Takeover

Accurately identify returning users, even if device, browser or behavioral elements change. Separate trusted and high-risk behavior as it happens to prevent intrusion of trusted accounts.

Learn more

Payment Fraud

Add upstream context to downstream checkout and payment workflows. Consolidate digital interactions with instore activity, such as rewards redemptions, via the Darwinium API.

Learn more

Scam Detection

Detect subtle signs of social engineering or coercion indicative of a potential scam, via journey-level behavioral analytics and behavioral biometrics. Identify remote access behaviors, live call detection and unusual payment patterns.

Learn more

Bonus Abuse

Uncover unwanted bonus-abuse behaviors, such as use of automated bots that can bypass captchas, cookie wiping and use of private browsing to bypass device recognition, and use of proxies and emulators to generate multiple new player bonuses.

Learn more

Uncovering Hidden Fraud in Minutes with Darwinium

Darwinium helped us identify fraud on multiple seller accounts that we hadn’t identified before. This is a really great example of value Darwinium has enabling the traceability and exploration of a threat or issue through to solution in a matter of minutes.

Nikolaus Brauer

Software Architect

Industries

Enrich checkout risk assessment with upstream context. Build digital interactions that create loyal customers, while protecting against account takeover, payment, shipping and returns fraud.

Your Cyberfraud System of Record

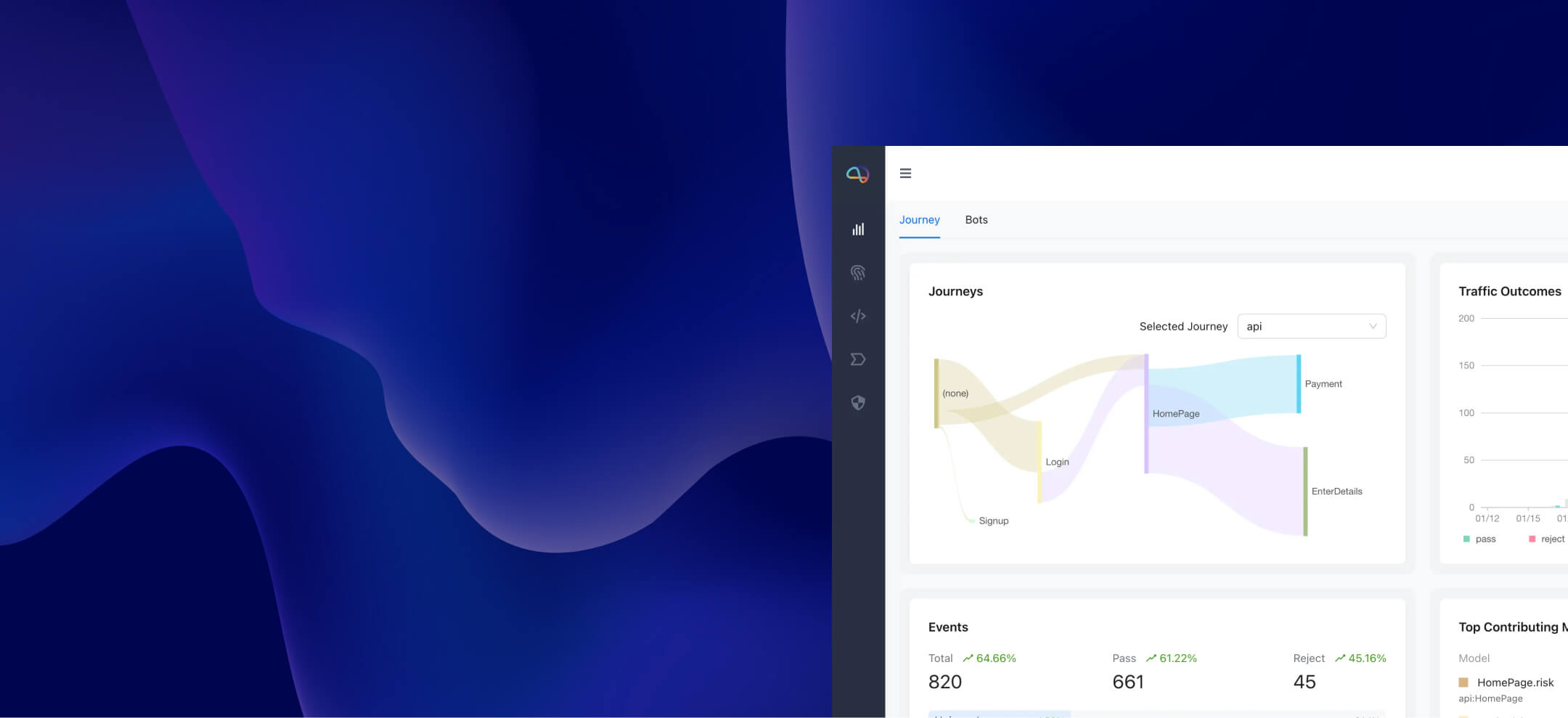

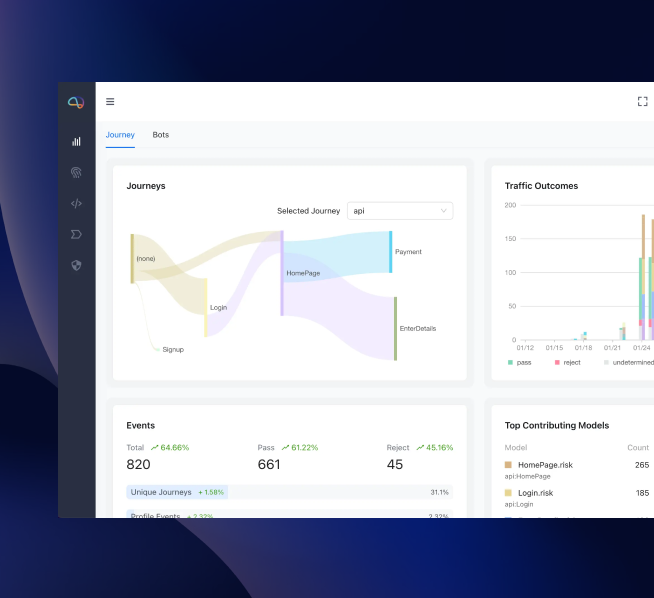

Consolidate multiple data siloes into a single source of truth across the customer journey. Collecting data from CDNs, APIs, web and mobile apps.

Customer Journey Visibility and Protection

Deploy cyberfraud prevention at the perimeter edge. Add network, device, behavior and endpoint context to security tools, and complete journey-level visibility to fraud teams.

Encode Behavior into Identity Across your Digital Estate

Darwinium has distilled sophisticated device and behavioral interactions into industry-first digital signatures to better separate trust from risk. Simplify vast amounts of data into actionable intelligence that can be compared for similarity. Find patterns of behavior, identity, content and context.

Since implementing Darwinium, we’ve seen a significant improvement in our ability to detect and respond to suspicious activities - particularly around account takeover, mule detection and payment fraud scenarios. The real-time alerts, device intelligence, and behavioral analysis have proven to be extremely effective in helping us safeguard our customer accounts.

D'fiama Pandiyan

Fraud Operations Lead at Boost

See a live integration in real time to experience the simplicity of Darwinium's time to value

Book a demo today